On March 15, Fed is expected to hike the rate the first time in 2017. Markets give a probability of 90% which is almost certain. They raised a 0.25% back in December 2016 and the fed funds rate is expected to be raised again to 0.75~1% next week.

What does this mean for mortgage rate?

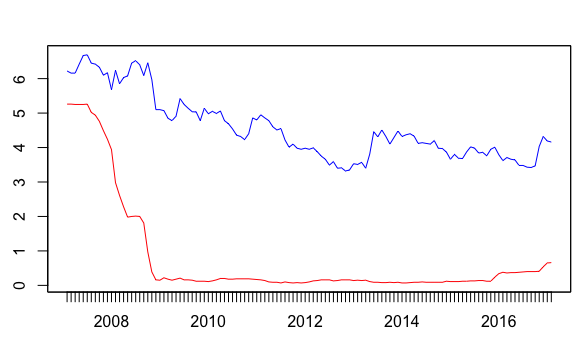

The following graph shows the fed rate(red) and 30-year fixed rate(blue) for the past. The fed has kept the rate low for 7 years already. In the same time, mortgage rate drops steadily. Also we see a big reaction in mortgage rate following the December fed rate decision last year. The mood has shifted by more hawkish fed.

We expect after the March rate hike, 30 year fixed would rise to 4.3~4.6% region.

Monthly payment

To put that in numbers, a 1% increase in mortgage rate would mean a extra $60 per month with a loan of $100,000, or around 12.5% increase of total price of the house.

If you need to consult or use a real estate agent, please contact Boston data realty.